University students organize protests to call for divestment from fossil fuels

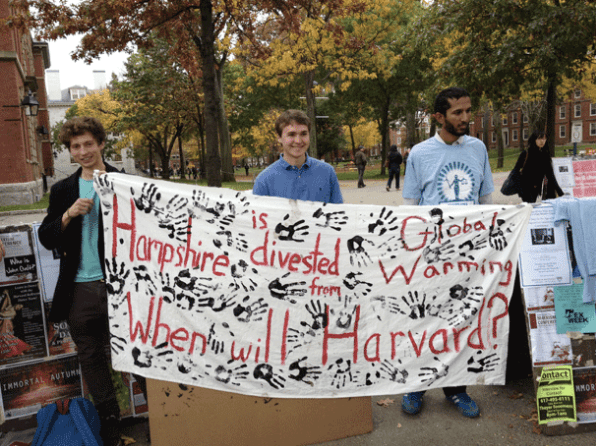

Harvard students hold up a sign calling on the university to divest from fossil fuels. (Photo by Annie Sneed.)

A new battle-line has formed in the wider push to rein in fossil fuel use – on college campuses.

Students at some 18 colleges and universities just held a National Day of Action to pressure their administrations to divest their endowment holdings from fossil fuel stocks, a move already taken by Hampshire College in Western Massachusetts.

Among the institutions involved are Cornell, Amherst, Bryn Mawr, Boston University — and the university with the fattest endowment of all, Harvard, where sophomore Alli Welton is leading the protests.

Welton says she and her fellow students are concerned about climate change.

“This issue will really determine the sort of planet that we live on and the society in which we have our lives. And I think it’s particularly strong to students because we see our entire lives spread out ahead of us,” she said.

She says climate change is already happening, as seen in the drought that Midwest this summer and the wildfires in Colorado are an example as well.

Not all of Harvard’s endowment investments are made public, so it’s hard to say for sure how much of it is invested in fossil fuel stocks. Activists have campaigned for years in an effort to convince universities to make their endowments transparents, but that rarely happens.

“The portions of the endowments that we are able to see, it is very clear that Harvard has invested in oil, coal, and natural gas companies, and the Harvard management company confirmed this with us,” Welton said.

Harvard says it’s in its best interest to have these investments to make money to support the college’s operations. That means, its leaders argue, funding research, financing facilities and educating students.

Welton says maximizing Harvard’s positive impact on the world should be the focus of its endowment, something it can best do by fighting climate change.

“Climate change is about whether or not Harvard survives as an institution, which is why we feel that it’s so important that we divest from fossil fuels,” she said.

Harvard officials argue that they aren’t being good stewards of their investments if they divest from fossil fuel companies.

“I understand that part of that is earning money off the endowment, so we can have an operational budget and such, but part of that is also that these investments in fossil fuel companies are also threatening Harvard,” Welton said. “Both our students, in terms of our lives, wherever we go in the world after this – climate change could really harm our lives or our chances of getting a job.”

In practical matters, Welton says, projection are that rising flood waters could bring the Charles River to the doorstep of Harvard’s dorms.

Chloe Maxmin joined Welton in protesting Harvard’s investments.

“Climate change is the defining issue of our generation,” she said. “Environmentalists have been trying to fight global warming by promoting individual action and changing light bulbs, and all that’s important and it brings those issues into the psyche, but when you turn on your light bulb, it’s still powered by coal. And so now this divestment movement is fighting the fossil fuel industry directly.”

Harvard officials say they have no intention of divesting.

“The university maintains a strong presumption against divesting itself of securities for reasons unrelated to investment purposes,” the statement said.