Peru’s avocado ‘green-gold’ rush loses some shine

Basilia Chuquispuma Castro is 54 years old and runs a family farm in a remote valley in Peru’s Ica region, about four hours south of Lima. The last hour of that drive is on a dirt road that cuts through dry, sandy hills.

Chuquispuma works the land with her parents and sons. The family has been growing beans, pumpkins and other vegetables on 12 acres. Last year, she had her first harvest of Hass avocados.

“My sons started to say, let’s plant Hass, Hass is for export,” she said.

Before that, she grew Fuerte avocados, the variety most commonly found at Peruvian markets — it’s a bit larger and has green skin. Hass was developed by postal worker Rudolph Hass in the 1920s in La Habra Heights, California, and has been transplanted everywhere. Particularly in the past eight years, consumption of Hass avocados has exploded as the industry highlighted its health benefits.

But Chuquispuma didn’t get a good price for her Hass this year. She sold most of her crop for less than 50 cents per kilo and her final harvest got just 20 cents — a fraction of the $1.30 per kilo she got last year. She is not part of a cooperative and doesn’t have a deal with a buyer; she sells her avocados to whomever comes by. Without a phone or internet, she doesn’t have access to other markets. And her costs are up.

“Fertilizer is super expensive, almost three times as much,” she said.

Chiquispuma is part of an agricultural revolution in Peru that has seen thousands of farmers switching to Hass avocados, hoping to profit from growing global demand. Peru’s avocado production increased more than fourfold in the past 12 years, and the country is now the second-largest exporter in the world, behind Mexico. It expects to export more than 600,000 tons of Hass avocado this year, according to Peru’s Ministry of Agriculture and Irrigation.

As Chiqispuma’s experiences show, Peru’s green-gold rush has lost some of its shine. After years of getting high prices for their fruit, Peruvian growers and exporters have seen the prices fall dramatically this season.

This is especially so in Europe, which is the largest market for Peruvian avocados (53%), followed by the US (16%) and Chile (14%), according to statistics from Peru’s National Agriculture Health Service (SENASA). Several players in Peru’s avocado market say higher oil prices due to the war in Ukraine and increased avocado farming across the world are to blame.

“Spain, Israel, and Morocco produced more fruit than last season,” said Omar Díaz Marchena, an agronomist and the general manager of Westfalia Fruit Peru, part of the South African company and one of many multinationals in the country.

Westfalia is one of the biggest exporters of Hass here and in the world. They buy the fruit from about 300 Peruvian farmers — 230 of them small. This year, they expect to export 46,000 tons of avocado, 15% more than last year, Díaz said.

One benefit to small farmers who sell crops to Westfalia is that the company gives them access to international markets, Díaz said.

“A grower in the Ayacucho region can sell to Japan, for example.”

Díaz said that the price per kilo the company is paying Peruvian growers fell about half from last year’s $2 high. Considering avocado production is growing globally, there is no going back. The $2-per-kilo era is probably over, he acknowledged.

Where does that leave the hundreds of Peruvian farmers who switched to Hass?

“The prices are still competitive and more profitable than other crops,” Díaz said.

Growing in a desert

Concerns about water are also increasing, especially in Peru’s coastal regions where much of its agricultural production is found.

“The problem is that the coast is a desert,” said Andrés Tello, a forest engineer.

About eight years ago, the government funded several massive irrigation projects in the coastal north, in the Olmos region, and that’s where many big companies grow Hass.

Tello explained that avocados need more water than other fruits, about 50% more than grapes. In the Ica region, the government prohibits new wells to avoid shortages. As wells dry out, some farmers are digging deeper, putting more pressure on water reserves.

“In some valleys it is reaching up to 150, 200 meters deep. Then it has already become groundwater,” he said. “That water is already like a nonrenewable resource.”

Carolina Ramírez Gonzalez, the director of economic studies at the Ministry of Agriculture and Irrigation, agreed that water is an issue but said that there are reasons so many of Peru’s avocados are grown in arid, coastal areas.

“It’s not because we wanted to do it like that, but because of logistics, maybe the facilities, several factors that are around companies or producers,” Ramírez said.

Harvesting the Andes

These water concerns are pushing avocado growers higher to the Sierra of the Andes. Ramírez said that farming the Sierra is more sustainable.

“We have water in the highlands,” she said. “We have to manage it well.”

Farming in the Sierra region also gives Peru an advantage in the global market because it allows it to harvest longer in the season.

“The supply of Peruvian avocado used to be during five months; now, it’s 10, 11 months a year,” said Juan Carlos Paredes Rosales, president of the Peruvian producers association ProHass, which represents 70% of the exporters.

In the Sierra near the town of San Miguel, a 12-hour drive south east of Lima, Rolando Campos Ludeña switched to Hass avocados from the corn and tomatoes he and his wife Mabel Palomino Marapi used to grow on their land on a steep mountain slope.

He’s doing better than Chuquispuma. For one, he grows organic avocados, which sell for more. And he sells to Westfalia, which he said offers him a better price.

“Before, there were buyers who would come by and offer whatever they wanted,” he said.

Campos said Hass has been profitable for his family. They built a house, bought a pickup truck and their son is headed to college in Bolivia to study medicine on a scholarship.

Other small farmers are not doing as well. In Peru, less than 20% of avocado exports come directly from small farmers, according to Cesar Armando Romero, an expert on international trade at the Ministry of Agriculture and Irrigation.

Armando explained that many small farmers are hesitant about joining cooperatives.

“It’s like a social trauma,” he said.

According to him, an agricultural reform that took place in Peru in the 1970s distributed land, but the cooperatives that were formed were plagued by corruption.

Image problem

Larger players have challenges too. With increased competition in Europe, they need to expand markets in Asia, and grab more of Mexico’s share in the US.

Rafael Molina Barentzen, director of operations and co-founder of American Fruits Export, recently opened an office in Florida, where he hopes to find ways to increase his sales in the US. But he is worried that an image problem will stand in his way. Last year, the company exported 500 tons of avocados — 70% to Chile and 15% each to Europe and the US.

“There is this bad perception of the Peruvian avocado” in the US, Molina said. “Unfortunately, we have created it ourselves because there have been exporters who send fruit that is not good.”

His company is also looking for land to grow its own avocado, giving the company more control over quality because they can’t always trust the farmers they buy from.

“You are not totally sure that they have carried out adequate control, that they have made the appropriate applications,” he said.

Cloned plants and climate change

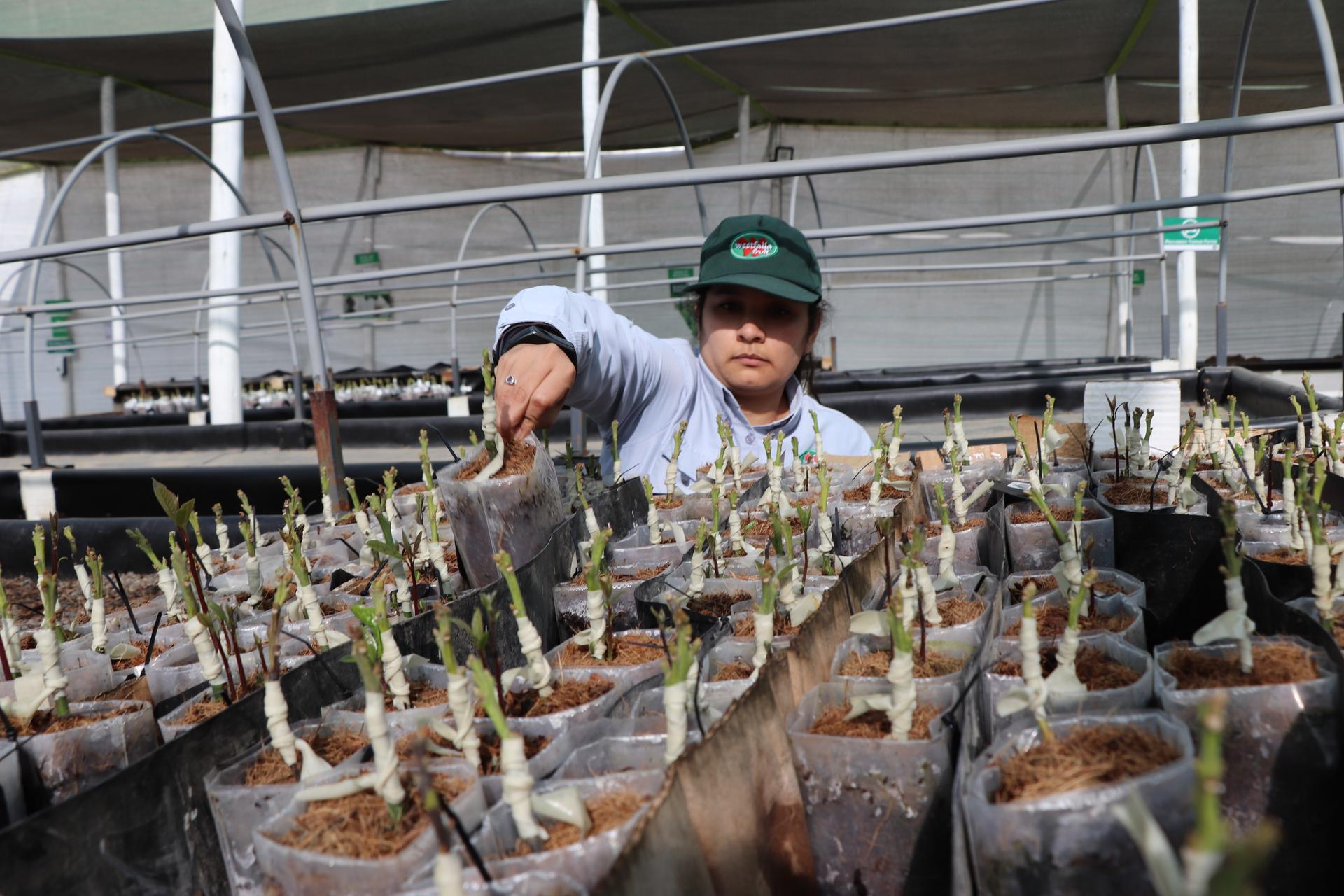

Molina is not the only one looking for ways to mine more profits from avocados in Peru. At Westfalia, agronomists are developing cloned Hass trees that produce more fruit and irrigation systems that save water.

And then, there is the challenge of a warming planet.

Miguel Gomez, a professor of applied economics and management at Cornell University and an expert in global food chains, said Peru is right to expand avocado farming away from the desert coast.

“One of the reasons for investing in avocados in the Sierra, I think, is in preparation for adaptation to climate change,” Gomez said. “One of the concerns in the future will be if temperatures warm in the coastal areas, it will become more difficult to produce avocados.”

Gomez said sustainability and increased production are necessary for Peru to remain an export leader.

“If I had to commit to something, I would say that avocado trade in international markets is going to double in 10 years’ time.” he said. “There is still huge room to increase consumption in Europe, but in India and China, the increase in avocado imports has been impressive.”

China is currently importing about 40,000 tons of avocados from different countries, according to the Hass Avocado Board. And, the US buys 1.5 million tons annually. It’s easy to see how Peruvian growers will need to lure both.

Vera Haller and Gisele Regatão are both journalism professors at Baruch College in New York City.

Support for this story was provided in part by a PSC-CUNY Award, jointly funded by The Professional Staff Congress and The City University of New York.

Our coverage reaches millions each week, but only a small fraction of listeners contribute to sustain our program. We still need 224 more people to donate $100 or $10/monthly to unlock our $67,000 match. Will you help us get there today?