How high would a carbon tax really have to be to rein in climate change?

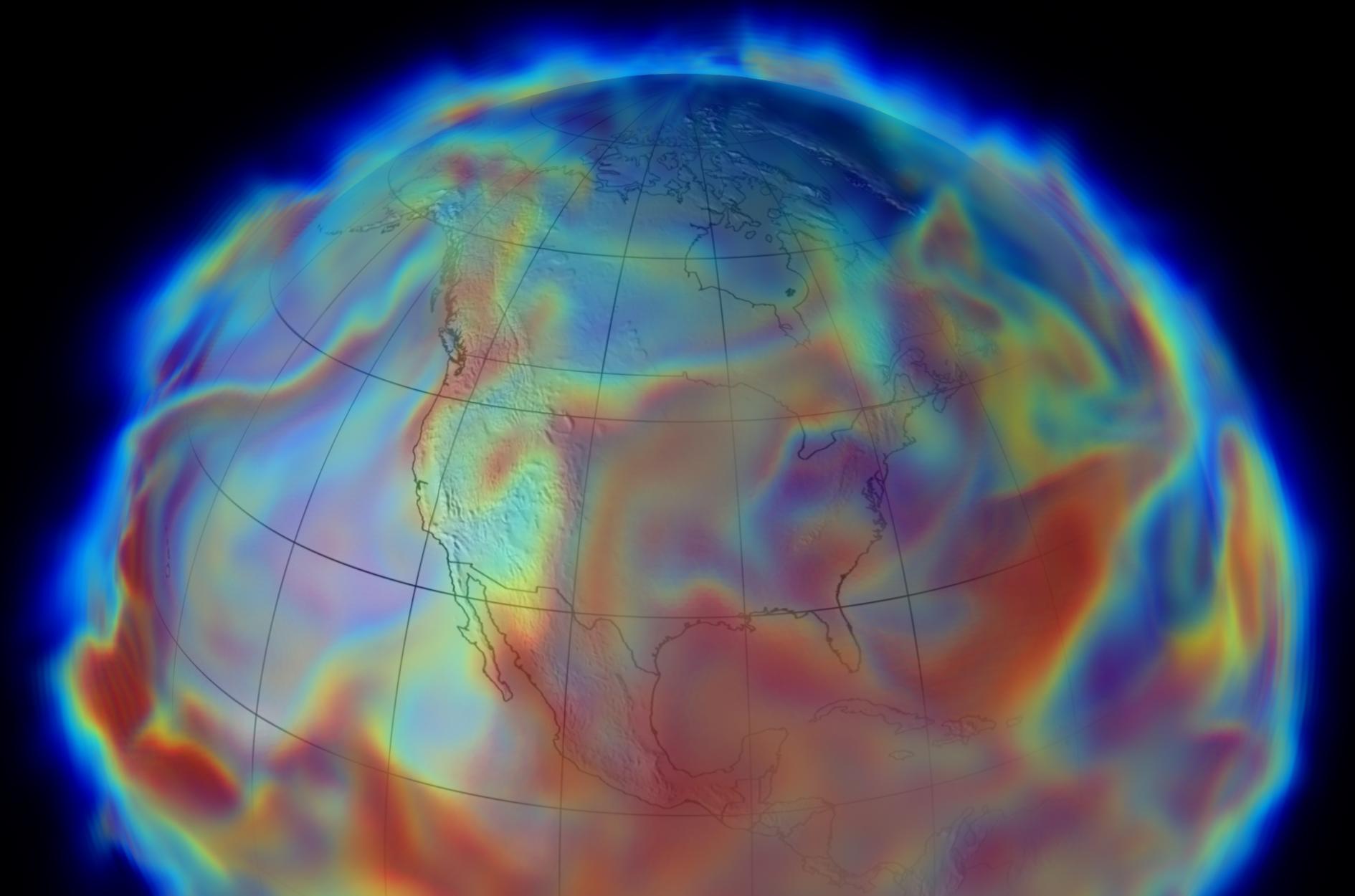

The Modern Era Retrospective-analysis for Research and Applications (MERRA) is producing a comprehensive record of Earth’s weather and climate from 1979, the beginning of the operational Earth observing satellite era, up to the present.

Former Treasury Secretary Henry Paulson published an opinion piece in the New York Times a week ago calling for a tax on carbon — and the idea of putting a price on carbon emissions is suddenly back in the news.

But do current economic models place a realistic price tag on carbon? A new paper from the London School of Economics Grantham Research Institute says “No.”

Professors Nicholas Stern and Simon Dietz contend that current models grossly underestimate the actual risks and costs of global warming. If we want to have the market rein in carbon pollution, say Stern and Dietz, we need to place a much higher price on carbon pollution.

The most widely-used economic model for calculating the economic cost of climate change is based on the work of Yale economist William Nordhaus. He called his model DICE — "Dynamic Integrated Climate Economy."

“You have to believe that Bill Nordhaus, when he came up with that acronym, had a twinkle in his eye,” says Charles Komanoff, director of the New York-based Carbon Tax Center, “because he knew that humanity was rolling the dice by continuing … to burn fossil fuels and pump climate disrupting carbon dioxide into the atmosphere.”

Komanoff says the new report focuses on three key flaws in Nordhaus’s model.

First, says Komanoff, is “the implicit assumption in the DICE model that regardless of the level of climate disruption, technical progress is going to continue unabated."

“When you think about it,” he explains, “climate change doesn’t just disrupt ecosystems. The disruptive effect of climate change is going to affect everything, including the ability of economies and innovators to generate new ways to produce economic growth.”

The second problem with the DICE model, according to the new paper, is that it does not account for the possibility and the consequences of reaching tipping points. As global temperatures increase, Komanoff explains, there are certain to be some very unwelcome surprises that will “pour more fuel onto the fire of climate change.”

For example, he says, as the permafrost in northern ecosystems melts, methane hydrates that have been stored for millions of years safely under the soil will be exposed to the atmosphere. Gram for gram, methane is a more potent warming gas than carbon dioxide.

Releasing all this methane could lead to a sudden and dramatic increase in the rate of warming “beyond what a simple linear extrapolation would lead us to expect,” says Komanoff.

The third problem with the DICE model, according to the new paper, is that it fails to include the issue of “fat-tails” — a statistical phenomenon that measures when extreme or rare events occur more frequently than expected.

For example, Komanoff says, “when you think about what’s going to happen to you or your family in the next year, you don’t expect that your house is going to burn down — yet you have fire insurance.”

Simon and Dietz argue society needs to have an insurance policy to guard against “fat-tails” — the unexpected ways in which a given amount of climate change is going to disrupt society.

This all leads to what Komanoff says is the real import of the paper: its assertion that the carbon tax rate will have to be set much higher than the current economic models envision.

“The new paper makes it clear that if we are going to rely on a carbon price as the primary policy tool to change the economic equations, and to hasten the de-carbonization of industrial activity … then the carbon price-rate, or the carbon tax rate, is going to have to be at least several times greater than what middle-of-the-road economists and UN economists have been willing to put out.”

Specifically, instead of considering $20 or $30 per metric ton an optimal level, that figure will need to be in the triple digits.

“The only question,” Komanoff concludes, “is: How fast do we get to triple digits, and how high up above $100 dollars per ton do we take it?”

This story is based on an interview from PRI's environmental news magazine, Living on Earth.

Former Treasury Secretary Henry Paulson published an opinion piece in the New York Times a week ago calling for a tax on carbon — and the idea of putting a price on carbon emissions is suddenly back in the news.

But do current economic models place a realistic price tag on carbon? A new paper from the London School of Economics Grantham Research Institute says “No.”

Professors Nicholas Stern and Simon Dietz contend that current models grossly underestimate the actual risks and costs of global warming. If we want to have the market rein in carbon pollution, say Stern and Dietz, we need to place a much higher price on carbon pollution.

The most widely-used economic model for calculating the economic cost of climate change is based on the work of Yale economist William Nordhaus. He called his model DICE — "Dynamic Integrated Climate Economy."

“You have to believe that Bill Nordhaus, when he came up with that acronym, had a twinkle in his eye,” says Charles Komanoff, director of the New York-based Carbon Tax Center, “because he knew that humanity was rolling the dice by continuing … to burn fossil fuels and pump climate disrupting carbon dioxide into the atmosphere.”

Komanoff says the new report focuses on three key flaws in Nordhaus’s model.

First, says Komanoff, is “the implicit assumption in the DICE model that regardless of the level of climate disruption, technical progress is going to continue unabated."

“When you think about it,” he explains, “climate change doesn’t just disrupt ecosystems. The disruptive effect of climate change is going to affect everything, including the ability of economies and innovators to generate new ways to produce economic growth.”

The second problem with the DICE model, according to the new paper, is that it does not account for the possibility and the consequences of reaching tipping points. As global temperatures increase, Komanoff explains, there are certain to be some very unwelcome surprises that will “pour more fuel onto the fire of climate change.”

For example, he says, as the permafrost in northern ecosystems melts, methane hydrates that have been stored for millions of years safely under the soil will be exposed to the atmosphere. Gram for gram, methane is a more potent warming gas than carbon dioxide.

Releasing all this methane could lead to a sudden and dramatic increase in the rate of warming “beyond what a simple linear extrapolation would lead us to expect,” says Komanoff.

The third problem with the DICE model, according to the new paper, is that it fails to include the issue of “fat-tails” — a statistical phenomenon that measures when extreme or rare events occur more frequently than expected.

For example, Komanoff says, “when you think about what’s going to happen to you or your family in the next year, you don’t expect that your house is going to burn down — yet you have fire insurance.”

Simon and Dietz argue society needs to have an insurance policy to guard against “fat-tails” — the unexpected ways in which a given amount of climate change is going to disrupt society.

This all leads to what Komanoff says is the real import of the paper: its assertion that the carbon tax rate will have to be set much higher than the current economic models envision.

“The new paper makes it clear that if we are going to rely on a carbon price as the primary policy tool to change the economic equations, and to hasten the de-carbonization of industrial activity … then the carbon price-rate, or the carbon tax rate, is going to have to be at least several times greater than what middle-of-the-road economists and UN economists have been willing to put out.”

Specifically, instead of considering $20 or $30 per metric ton an optimal level, that figure will need to be in the triple digits.

“The only question,” Komanoff concludes, “is: How fast do we get to triple digits, and how high up above $100 dollars per ton do we take it?”

This story is based on an interview from PRI's environmental news magazine, Living on Earth.