MF Global terminates entire workforce

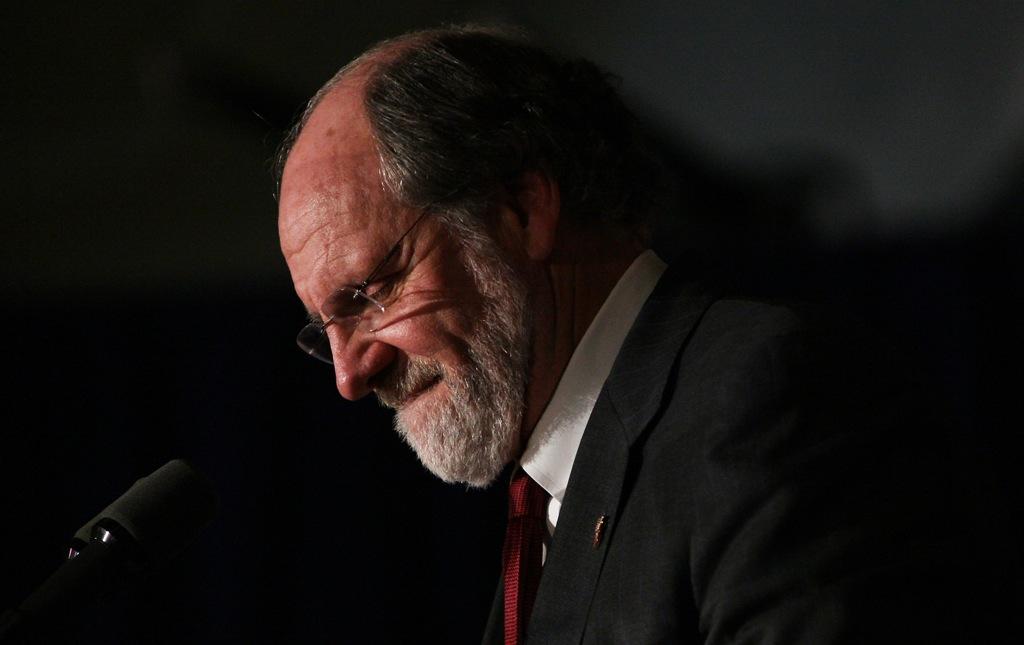

Jon Corzine, formerly of MF Global and Goldman Sachs.

MF Global has fired the entire brokerage arm of its workforce, 1,066 employees, Reuters reported.

According to Reuters, trustee James Giddens, in charge of liquidating assets, released a statement Friday that said workers were notified their employment as been terminated immediately, though they still will be paid through Tuesday. Those terminated will not received severance pay and will receive health benefits until Nov. 30., a source told The New York Times.

Giddens said Friday's terminations were "a necessary part of the court-ordered liquidation of MF Global and is consistent with the trustee’s obligations…to preserve assets," Fox News reported.

The unit of terminated employees includes brokers, traders, salespeople and operations staff located in New York, Chicago, San Francisco, Houston, Kansas City, Boston and Washington, D.C., FINS Finance reported.

Read more at GlobalPost: Jon Corzine resigns from bankrupt MF Global

Only a skeleton of its staff has been kept on to assist in the dissolution of the business, The Times reported. Giddens is supposed to rehire 150 to 200 employees to deal with broker-dealer and bankruptcy claims. A source told The Times that some of those that will be rehired left MF Global weeks ago. However, the terminations will not apply to the parent company, MF Global Holdings, which listed 2,847 as of September 2011, Fox News reported.

The company said it is working to vacate its headquarters in New York as soon as possible and will close the facility, the Associated Press reported.

A source told FINS Finance that some people who are being fired have been assisting in the investigation of missing customer funds estimated now to a total of about $600 million. Originally employees were to be notified via email but then MF Global decided to hold town meetings to let workers know verbally, the source told FINS.

Read more at GlobalPost: FBI joins the probe on MF Global

On Oct. 31 MF Global, a New York based-securities company, announced it was filing for bankruptcy after making bad bets on European soverign debt, the eighth largest Chapter 11 filing in US history. But the firm truly came under fire when it was reported that they were unable to account for more than $700 million in customer accounts, leading to the SEC and CFTC to investigate. MF Global had informed the CFTC and SEC there were "possible deficiencies in customer futures segregated accounts held at the firm."

Only days later, MF Global head and former New Jersey Governor, Jon Corzine resigned from his post as chairman.

Over the last few weeks, other layoffs at MF Global have taken place, except in a lighter fashion. There have been about 165 layoffs in the Chicago and New York offices, a source told FINS. Like the employees fired today, they will not be receiving severance pay or medical benefits past November.

Every day, reporters and producers at The World are hard at work bringing you human-centered news from across the globe. But we can’t do it without you. We need your support to ensure we can continue this work for another year.

Make a gift today, and you’ll help us unlock a matching gift of $67,000!