Obama’s EU free trade agreement would mean higher heating costs for Americans

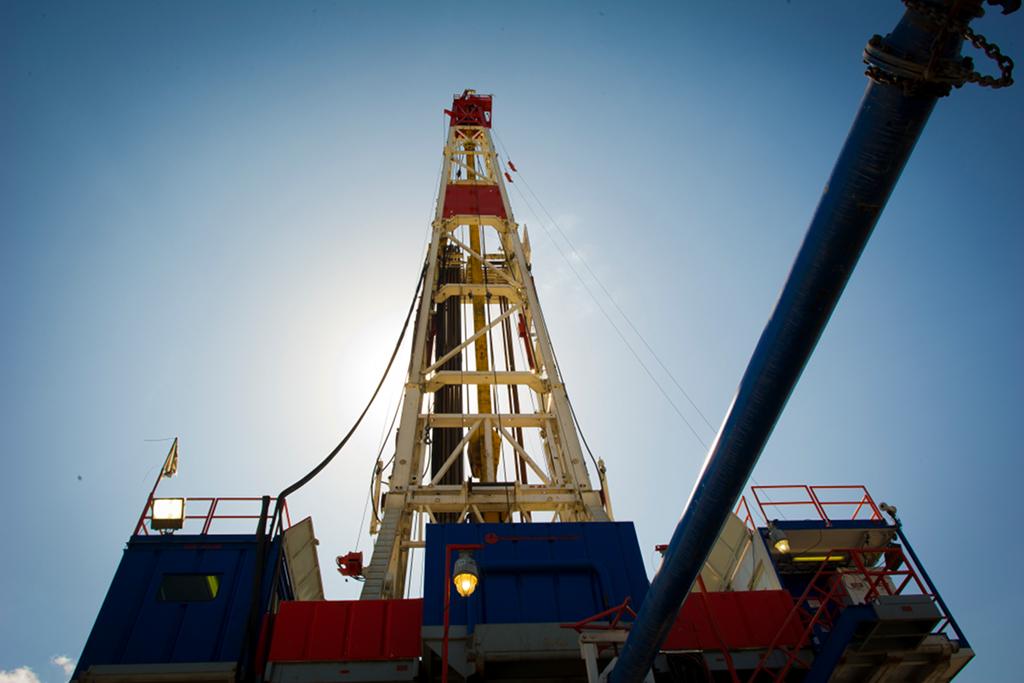

A Consol Energy horizontal gas drilling rig explores the Marcellus Shale outside the town of Waynesburg, PA on Apr. 13, 2012.

Last week, President Obama mentioned signing a free trade agreement with the European Union in his state of the union address.

As with anything, the benefits of such an agreement comes with its costs.

Morgan Stanley commodities analyst Adam Longson believes this is the path to higher natural gas prices.

Longson writes in a note today that opening up a new market would be a boon for natural gas producers as prices rise with the new demand.

This means higher costs for consumers who rely on natural gas (currently at $3.25/mmBtu) for things like heating and cooking.

It would also change the trajectory of some pipeline projects:

At today’s European prices, US natural gas could rise as high as $5.70/mmBtu before closing the trans-Atlantic LNG export arb (i.e. the exchange rate setttlement — ed). We believe a new FTA has the potential to alter the timeline and destination for some LNG exports projects. We view East Coast projects, like Dominion’s Cove Point, as the greatest beneficiaries.

Longson says there's also the potential for expanded oil exports. However, the impact on US light sweet crude would not be as dramatic.

![]()

More from our partner, Business Insider:

Business Insider: The Truth About Marissa Mayer's Surprise Deal With Google

Business Insider: How Location-Based Services Are Transforming The Mobile Industry

Business Insider: Pinterest Just Made Its First Big Entertainment Deal With 'The Biggest Loser'

Business Insider: Missouri Legislator Wants To Make It A Felony To Propose Gun Control Legislation

Business Insider: 7 Details About The Belgian Diamond Heist That'll Definitely Make The Movie

Every day, reporters and producers at The World are hard at work bringing you human-centered news from across the globe. But we can’t do it without you. We need your support to ensure we can continue this work for another year.

Make a gift today, and you’ll help us unlock a matching gift of $67,000!