Asia markets fear Romney presidency

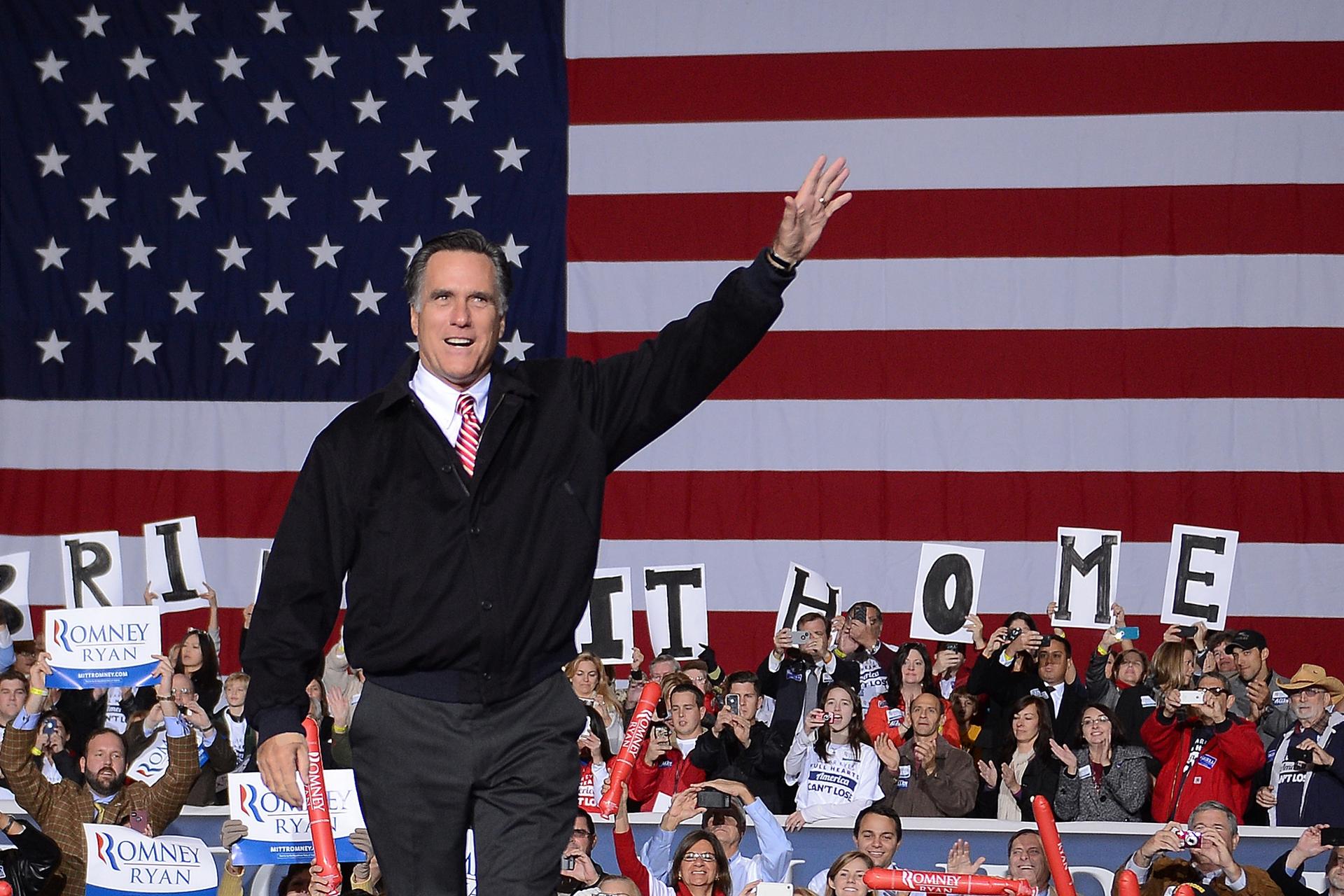

US Republican Presidential candidate Mitt Romney holds a rally in Virginia Beach, Va., Nov. 01.

While investment strategists in the US view a Republican victory as positive for the stock market given their presidential candidate Mitt Romney’s pro-business policies, market players in Asia believe a win for the former Massachusetts Governor would in fact be negative for equities on their side of the world.

At a time of heightened uncertainty, with the ongoing European debt crisis and the upcoming leadership transition in China, a new president in the world’s largest economy will cause additional nervousness among Asian investors, experts told CNBC.

“Asian traders don’t like change in leadership. You would see weakness in the markets if Romney won, because people would question how well he would deal with the impending doom of the ‘fiscal cliff.’ Obama would be a safer bet, as investors would enjoy continuity at a time of a lot of uncertainty,” said Justin Harper, market strategist, at IG Markets.

“Because of his four years in power, Obama is better positioned to deal with Congress at trying to negotiate programs to give the economy time to find its feet,” he added.

Besides, Romney’s stance on China is particularly worrying feels Harper. The presidential hopeful has said he will name China a “currency manipulator,” which could lead to more tensions with the mainland, including on the trade front.

“You would expect trade between the two nations to suffer, this would have a knee-jerk reaction on trade in the region,” he added.

Mitul Kotecha, head of global foreign exchange strategy for Credit Agricole, added that if Romney were to take a tougher stance on the Chinese currency, and put pressure on the government to let the yuan appreciate further, it would force other Asian currencies higher and could hurt the competiveness of economies in the region that depend on exports.

Correlations between Asian currencies and the yuan are stronger than between them and the US dollar, Kotecha said.

On top of Romney’s stance on China, Mohammed Apabhai, head of Asia trading strategy at Citigroup, said his leadership may be negative for Asian markets in the longer-term because of his reluctant to provide more stimulus — which is now a critical driver of risk appetite in the markets.

“The statements coming out from Romney range from the replacement of Ben Bernanke (as the chairman of the Federal Reserve) to anti-QE (quantitative easing) statements — it’s a very different rhetoric that could tie the hands of the Fed,” Apabhai said.

“Some of Romney's advisors have said that QE3 would not be effective at all, with vice president candidate Paul Ryan arguing that QE3 is not needed,” he said

Romney has indicated he will not reappoint Bernanke when his term expires in January 2014 and this would likely see a less dovish Fed Chairman appointed, said analysts.

More from GlobalPost: What if China could vote in the US election?

While a Romney victory may weigh on Asian markets, strategists say an Obama win would not produce big gains, either.

“If Obama wins, I don’t think there will be much of a reaction. It will be business as usual, more of the same,” said Shane Oliver, head of investment strategy and chief economist at AMP Capital.

More from our partner, CNBC:

CNBC: Mobile Wars: Pandora's Got Frenemies

CNBC: Without Power, Silicon Alley Goes in Search of New Digs

CNBC: What's the Best Smartphone in an Emergency?

Every day, reporters and producers at The World are hard at work bringing you human-centered news from across the globe. But we can’t do it without you. We need your support to ensure we can continue this work for another year.

Make a gift today, and you’ll help us unlock a matching gift of $67,000!