Why the feds aren’t shutting down Bitcoin — yet

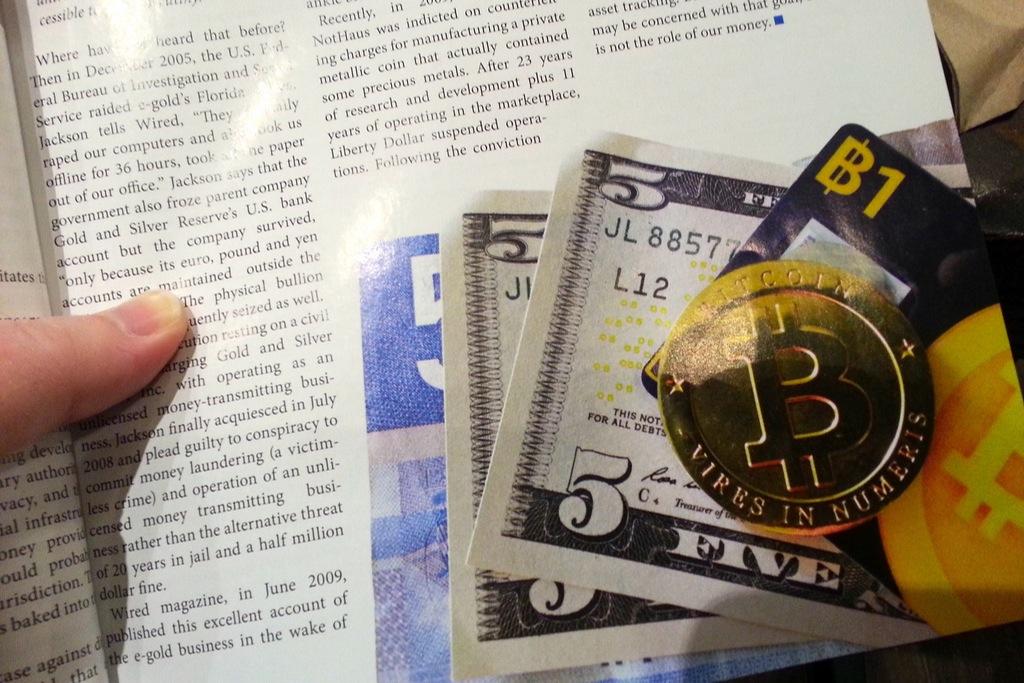

What physical Bitcoins could look like, shown in the December 2012 issue of Bitcoin Magazine.

It's illegal to make your own money in the United States, but that doesn't mean the feds will shut down the digital currency bitcoin anytime soon, financial services lawyer Dan Friedberg tells us.

That's because the feds don't consider bitcoin — a virtual currency that's being used around the globe — to be "tender," or official bills or coins that look like they've been issued by the US government. Instead, it's considered "virtual currency."

The federal government made that distinction clear in a recent announcement that it was applying money-laundering rules to bitcoin and other virtual currencies.

The Treasury Financial Crimes Enforcement Network (FinCEN) didn't mention bitcoin by name, but the new rules applied to "convertible decentralized virtual currency" exactly like bitcoin, Friedberg says.

Bitcoin enthusiasts were a little on edge before FinCEN issued its notice.

"This is a a very new area, and you really never know how the Treasury Department is going to react," Friedberg says.

Here's what Friedberg had to say in an email message:

"Prior to the FinCEN release, a significant concern was that the US government might assert that bitcoin constitutes illegal tender. Indeed, the United States Constitution delegates to Congress the exclusive power to mint coin within the United States to insure a singular monetary system for purchases and debits. The Department of Treasury therefore could have taken the position that bitcoin constitutes an illegal competing currency that violates this fundamental constitutional power, but chose not to do so. Instead, FinCEN distinguished a 'virtual currency' from a 'real currency,' and noted that a 'virtual currency lacks all the real attributes of real currency.'"

It's possible that the federal government is letting bitcoin stick around because it's not much of a threat to US currency. Right now, bitcoin's only worth about $1 billion compared to the $1.18 trillion in US currency that's in circulation.

Bitcoin is also relatively unstable, Internet law attorney Mike Young points out.

"If Bitcoin exchange rates stabilize, and the digital currency becomes preferred over the US Dollar at some point, that would be the probable tipping point for banning it within the United States," Young tells us.

For now, bitcoin is able to exist in part because it's in the "gray area" of international currency that's based overseas, according to Young.

"If Bitcoin were purely a US domestic currency," Young says, "it would have been shut down a long time ago."

SEE ALSO: A complete guide to what Bitcoin really is —>

More from our partner, Business Insider:

Business Insider: If You Think China's Air Is Bad, You Should See The Water

Business Insider: What 12 Now-Famous Tech Executives Looked Like When They Were Young

Business Insider: HTML5 vs. Apps: Where The Debate Stands Now, And Why It Matters

Business Insider: The Most Successful Founders Are Greedy (But Not For Money)

Business Insider: Angry Twitterers Are Threatening To Switch To Bing After Google Honors Labor Leader Cesar Chavez On Easter