The 6 most surprising ways the US government is spending your taxes

Your accountant may tell you how much you owe in federal taxes this year, but they won't likely tell you how your money is spent.

Sure, we all know Washington needs cash for things like Social Security and Medicaid.

But did you know you'll pay an average of $81.50 toward America's nuclear weapons this year?

Or that around $1,600 will help Uncle Sam pay the interest on our national debt?

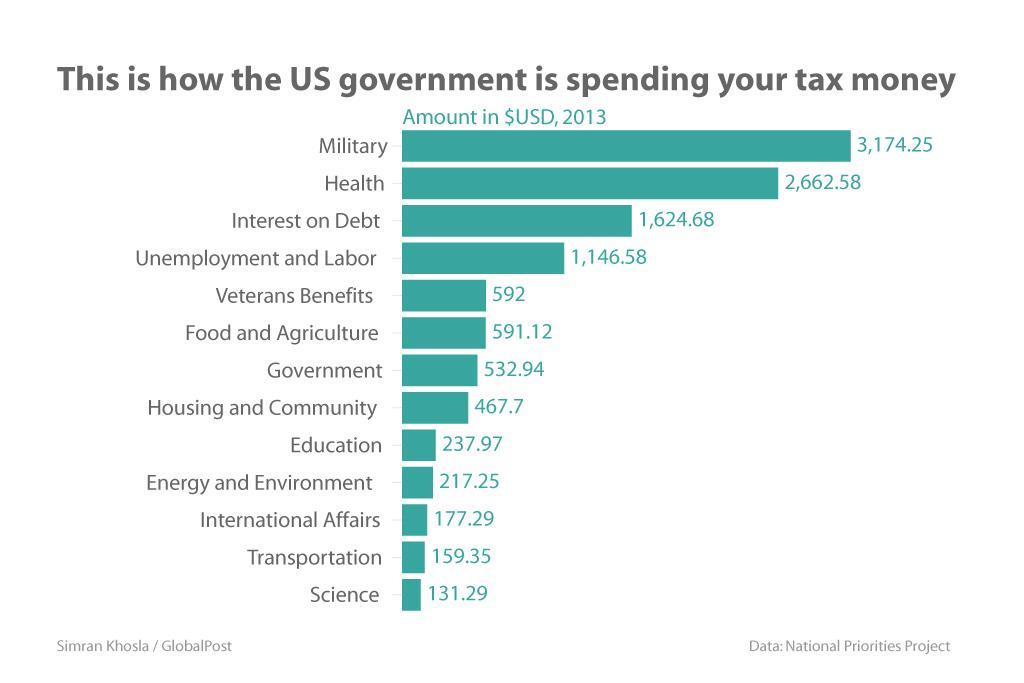

The National Priorities Project has done all the math, breaking down where your taxes go based on 2013 federal spending.

Their calculator lets you plug in your federal taxes owed for a look at what you're paying for.

Here are six surprising ways Washington is spending your money, based on the average federal tax bill of $11,715 in 2013:

1. Emergency aid for public transportation

We're betting you probably didn't know that an estimated $4.66 your taxes goes toward a Federal Transit Administration program that assists public transit agencies in the aftermath of a major disaster or emergency like floods and hurricanes.

So yeah. It's not just the Red Cross that comes to people's aid.

When the next Superstorm Sandy floods the New York subway system? You're paying.

2. Veteran pensions

Benefits for the nation's veterans take up about 5 percent of your federal income taxes, and that includes their pensions.

The Pentagon is proposing cuts to pension increases for working-age military retirees as part of its 2015 budget.

But you'll still pay an average of $22.32 toward them last year.

3. Nuclear weapons

Most Americans know a big chunk of their tax dollars go toward the country's massive military and defense budget.

But $81.50 of your tax bill this year will go toward developing nuclear weapons and maintaining the 5,113 warheads the US already has.

So much being anti-nuke.

4. Interest on debt

It probably comes as a shock to no one that Uncle Sam can't pay for his entire budget with the tax dollars he collects every year.

So he borrows money — $1.3 trillion in 2011, for example — to fill in the gaps.

Last year, the average taxpayer will shell out $1,624 toward the interest on that debt.

5. Public broadcasting

There was a big hullabaloo a couple years ago when the House voted to cut National Public Radio funding.

Many people didn't even know part of their taxes paid for public broadcasting, while others thought they were footing a much larger part of the bill.

So what's the reality?

According to the National Priorities Project, just $1.90 of the average federal tax bill goes toward funding for the Corporation for Public Broadcasting.

6. Border protection

Keeping undocumented immigrants out of the US has been a big (and costly) business for the government for years now.

Customs and Border Protection spent $2.4 billion between 2006 and 2009 to build 670 miles of border fence. And there was a proposal last year (which ultimately died) that called for 700 more.

Last year, the average taxpayer will pay $53.50 toward border protection.

The story you just read is accessible and free to all because thousands of listeners and readers contribute to our nonprofit newsroom. We go deep to bring you the human-centered international reporting that you know you can trust. To do this work and to do it well, we rely on the support of our listeners. If you appreciated our coverage this year, if there was a story that made you pause or a song that moved you, would you consider making a gift to sustain our work through 2024 and beyond?