HSBC’s money-laundering scandal to cost over $1.5 billion (VIDEO)

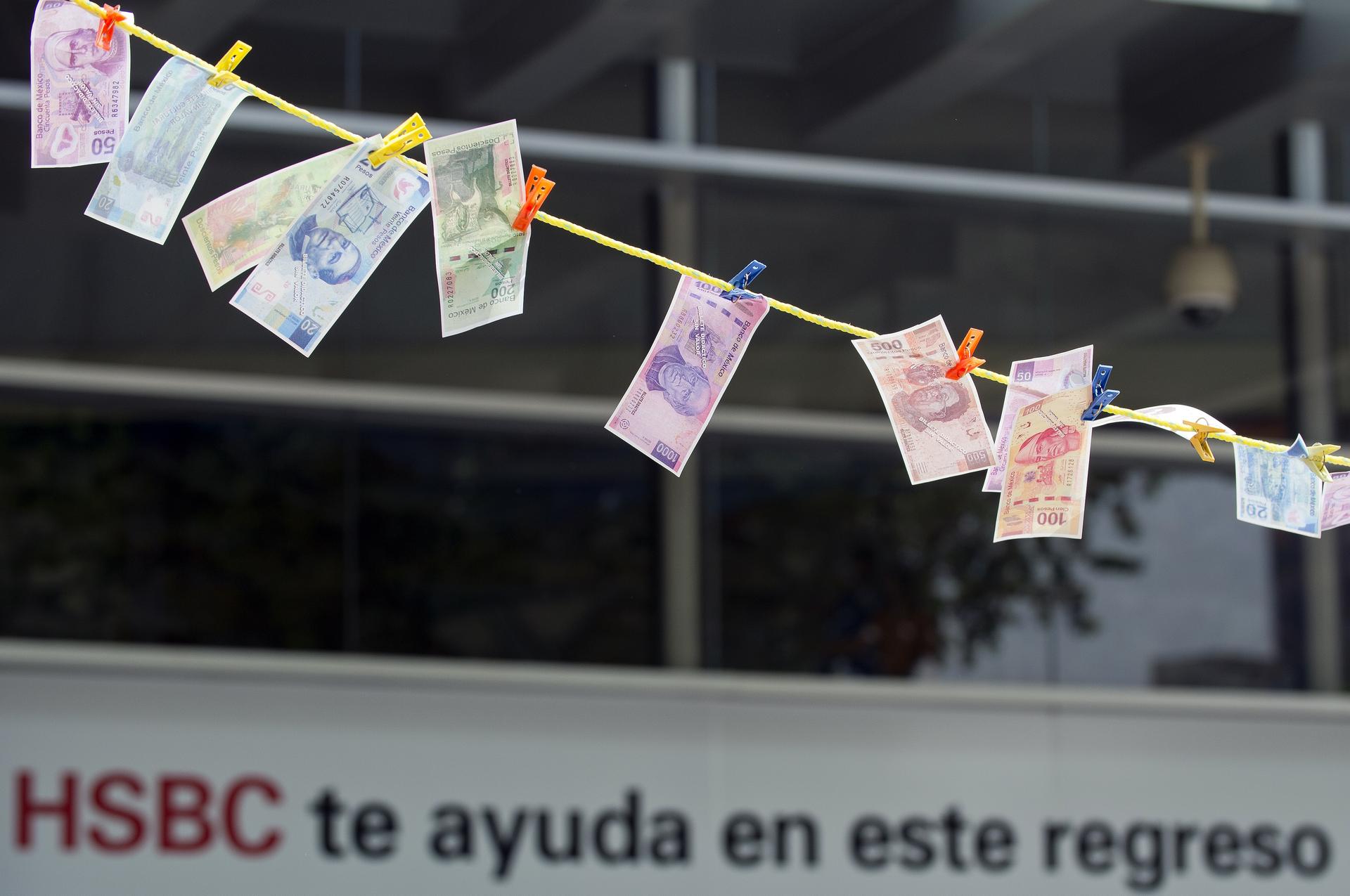

Fake notes were hung out to dry during a protest in front of HSBC in Mexico City on July 30. The bank was fined for failing to apply anti-money laundering rules.

The UK's HSBC bank said Monday that penalty estimates for allegedly breaching anti-money laundering regulations stand at over $1.5 billion and the case is likely to lead to criminal charges from the United States, Reuters reported.

The scandal has rocked Europe's financial establishment and crippled the continent's largest bank, which stands accused of various legal breaches, including turning a blind eye to the laundering of Mexican drug money, said the Financial Times.

The settlement "could be significantly higher" than the latest estimates, Reuters cited HSBC Chief Executive Stuart Gulliver telling reporters today. FT said costs could reach more than $2 billion.

Final fees are to be determined in the coming weeks. While the penalties are significant, FT said HSBC's $166 billion in equity is expected to help it weather the financial crisis.

“The final number could be $2bn or even $3bn, but it wouldn't hurt the fundamental financials of the bank,” one banking analyst told FT.

Nonetheless, the affair has angered the public. Responding to Monday's fresh estimates, the Guardian's Nil Prately expressed frustration with the bank for not doing more to hold its leadership accountable for the mess.

People want "a fuller account of how the Mexican operation, in particular, fell so short of acceptable standards," he said, adding, "When a settlement is finally reached, the bank should tell all" and "the blushes of former bosses shouldn't enter the equation."

Watch the Financial Times' video report on the news below: