Trump to ‘make own mark’ with Fed pick

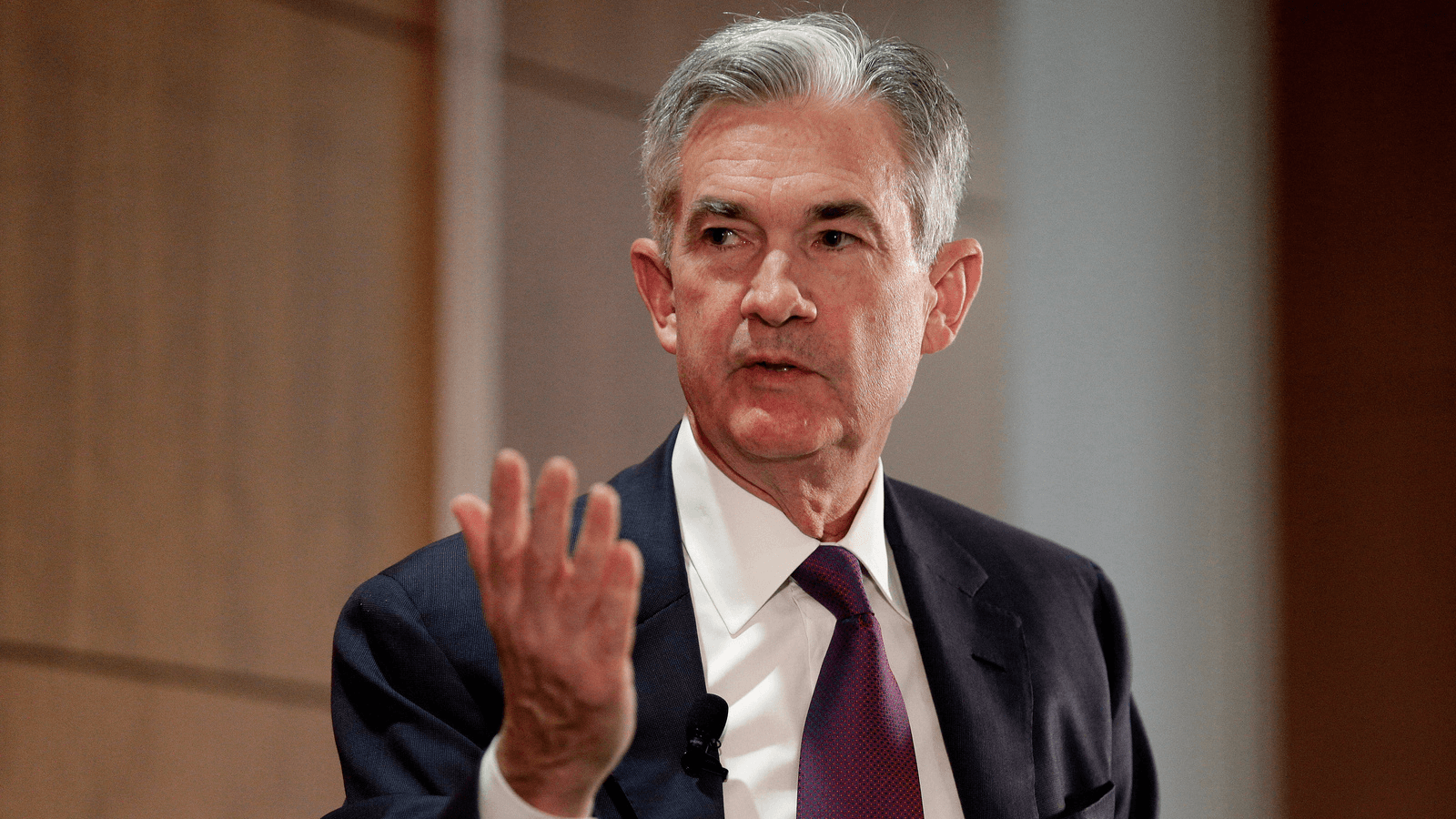

Federal Reserve Board Governor Jerome Powell discusses financial regulation in Washington, D.C., Oct. 3, 2017.

President Donald Trump was poised Thursday to nominate Federal Reserve Governor Jerome Powell to lead the central bank, putting his own imprimatur on monetary policy as the US economic recovery solidifies.

Trump will announce his pick in the Rose Garden at 3:00 p.m. Eastern Daylight Time to replace current Fed Chair Janet Yellen, whose term at the helm of the central bank expires in February.

Powell, who was reportedly informed by Trump in a phone call early this week, is seen as the consensus choice.

The 64-year-old Republican has echoed the administration's views on bank deregulation but has supported the Yellen Fed's very gradual increases, which is in keeping with Trump's desire to keep interest rates low.

Trump on Wednesday reiterated that he holds Yellen in high regard, calling her "excellent." But he has also made clear he wants to make his own mark.

The move will make Trump the first president in nearly 40 years not to keep the Fed chair appointed by the prior administration.

The announcement caps a highly publicized selection process over weeks during which Trump built suspense using social media and television appearances to describe his deliberations.

"I think you will be extremely impressed by this person," Trump told reporters about his choice again on Wednesday.

Yellen has led the central bank since 2014 and steps down just as the post-crisis US economic recovery has begun to crest, with falling unemployment, robust growth and low inflation, conditions that have won her praise in many quarters.

The question now is whether she will follow tradition and resign as a member of the Fed's board of governors, once her term as chair expires Feb. 3. She could stay on through January 2024, and there are growing voices for her to do so to help guide monetary policy.

There currently are just four members on the seven-member Fed board, and if Yellen leaves Trump could appoint four more governors.

The 'continuity candidate'

Though his administration has been engulfed in turmoil virtually from the start, Trump has repeatedly hailed the country's smooth economic progress and Wall Street's successive rallies, making the prospect of disrupting the status quo particularly fraught.

"Jerome Powell is the continuity candidate, at least as far as near-term monetary policy is concerned," Ian Shepherdson of Pantheon Macroeconomics said a client briefing.

"Of all the apparent candidates, excluding Dr. Yellen, Mr. Powell is the least likely to disrupt the Fed, at least on the monetary policy front."

But Trump also has relished dismantling the political vestiges of the Obama administration and told Fox News last month, "you like to make your own mark."

In another break with tradition, Powell is not a trained economist. Even so, Terry Sheehan of Oxford Economics said he has received a working education and is "well-qualified" to serve as Fed chair, though she warned he may have to defend the Fed's independence "in a hostile political environment."

Other candidates considered for the position included former Fed governor Kevin Warsh and Stanford economist John Taylor, who favored raising interest rates much more quickly. That would send unhappy ripples through markets, not something Trump is keen on.

Powell is similar to other Trump appointees: He is a former investment banker with a declared personal fortune ranging between about $20 million and $55 million after nearly a decade at the Washington-based private equity firm Carlyle Group. Fellow Fed Governor Randal Quarles, a Trump appointee, is also a former Carlyle partner.