Bitcoin survives sell-off, returns to last week’s valuation

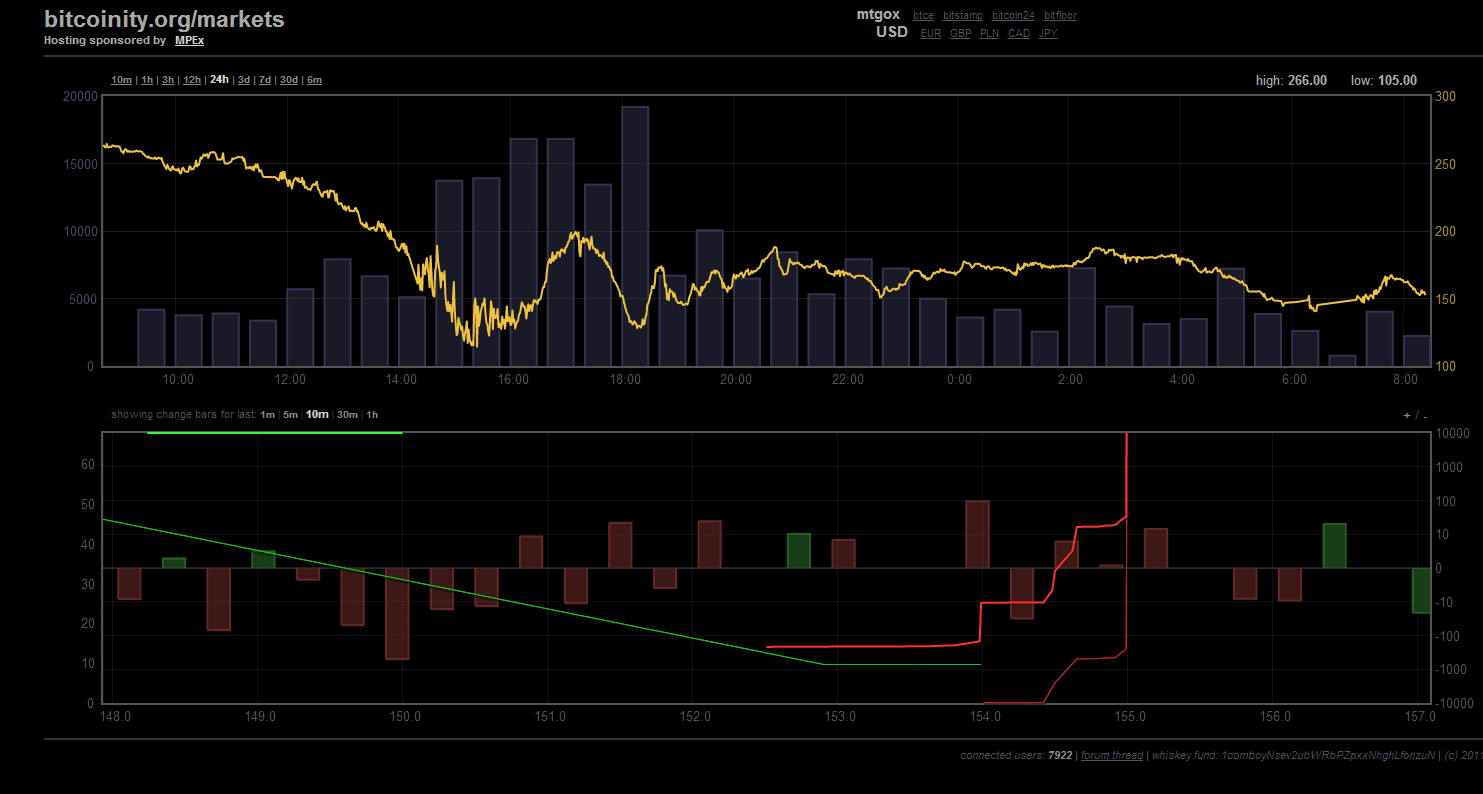

A graph from bitcoinity.org displaying Wednesday’s Bitcoin devaluation

The virtual currency Bitcoin suffered steep devaluation on Wednesday, falling from $266 to $105 and inducing a sell-off before leveling out at $120 on Thursday.

Bitcoin users began furiously searching for an explanation Wednesday as the value of Bitcoin tumbled. Theories included government conspiracies to devalue Bitcoin; attempted market manipulation by hackers; DDoS attacks or a simple market self-correction.

While many were quick to declare an end to the Bitcoin bubble, Bitcoin has still retained significant value. Even following Wednesday’s panic, Bitcoin’s value has still increased by approximately $20 since its April 1 valuation at $100.

More from GlobalPost: As value of Bitcoin explodes upward, former Bitcoin gambling addict laments losses

"Most transactions are still coming from affluent regions, like the United States and northern Europe. What we are seeing is not a Cyprus bubble," Bitcoin foundation member Jon Matonis pointed told the Guardian.

Mt. Gox, the world’s largest Bitcoin currency exchange, explained that a large influx of new accounts early Wednesday caused their system to experience heavy amounts of lag. In spite of calls to remain calm, as the time for transactions to process lengthened, users — suspecting a market crash — began selling large amounts of Bitcoin.

On Thursday afternoon, Mt. Gox suspended Bitcoin trading until 2 a.m. GMT Friday to allow for market "cooldown."

More from GlobalPost: As DDoS attack strengthens, US Banks scramble to mitigate website outages

“… We would like to reassure you but no we were not last night victim of a DDoS but instead victim of our own success!” read a statement released by Mt. Gox on Thursday.

“Indeed the rather astonishing amount of new account opened in the last few days added to the existing one plus the number of trade made a huge impact on the overall system that started to lag. As expected in such situation people started to panic, started to sell Bitcoin in mass (Panic Sale) resulting in an increase of trade that ultimately froze the trade engine!” read the statement.

Bitcoin users were quick to condemn Mt. Gox for waiting until hours after the crash to inform users why transactions were so slow — since that slowness had only worsened the panic.

More from GlobalPost: Redditor uses forum to confess to alleged murder

Calling Mt. Gox a de facto Bitcoin central bank, many users are encouraging other Bitcoin advocates to take their business to other currency exchanges, hoping to avoid another crash induced by a lack of information from exchange platforms.

“Right now MtGox acts more and more like a central bank. It sets the price of Bitcoin. If it breaks, the price breaks too (goes down). And again people start talking about decentralized exchanges. We already have a lot of exchanges. Just start using them! Arbitrage traders/bots will do the rest,” wrote one user of bitcointalk.org, a popular Bitcoin discussion forum.

Users across the internet also called on the Bitcoin community to begin using alternatives to Mt. Gox.

Every day, reporters and producers at The World are hard at work bringing you human-centered news from across the globe. But we can’t do it without you. We need your support to ensure we can continue this work for another year.

Make a gift today, and you’ll help us unlock a matching gift of $67,000!