UBS net profit slumps 58% in second quarter on botched Facebook listing

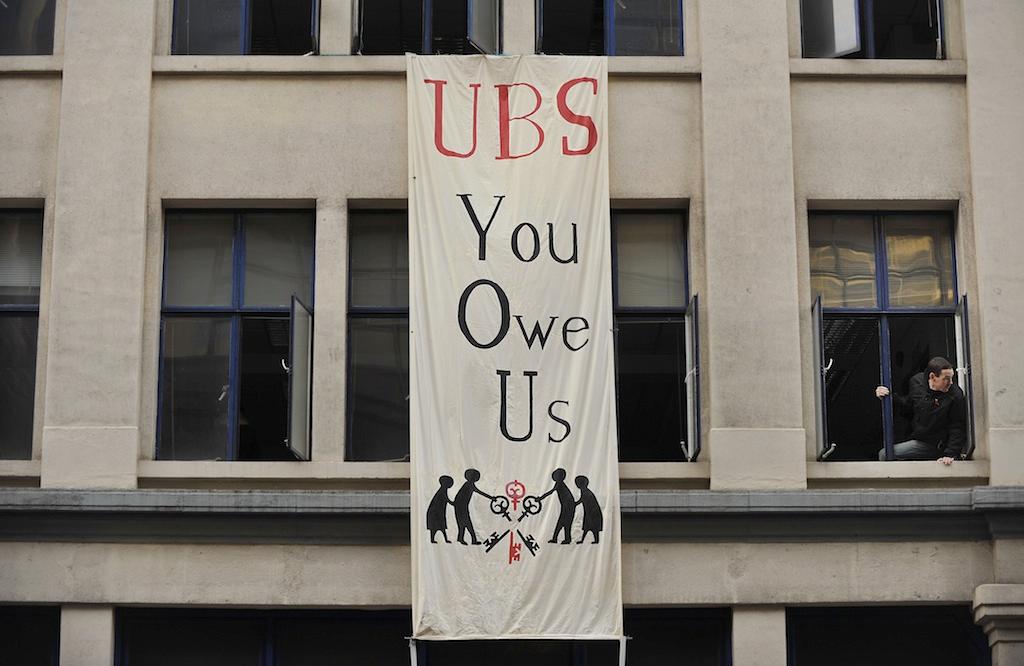

Anti-capitalist activists hang banners on the outside of an empty office block owned by Swiss banking giant UBS in London on November 18, 2011.

Swiss banking giant UBS today reported a 58 percent drop in second-quarter net profit, partly due to Facebook’s botched listing in May.

UBS said it plans to take legal action against Nasdaq OMX Group after technology glitches during the social networking site's high profile debut prevented the bank from executing trades, costing it 349 million Swiss francs ($357 million), the Wall Street Journal reported.

Nasdaq has said it will pay $62 million in compensation to firms that lost money due to the technology problems. But it may not be enough.

“We will take appropriate legal action against Nasdaq to address its gross mishandling of the offering and its substantial failures to perform its duties,” the bank said.

More from GlobalPost:Facebook earning report fails to wow investors

Its net profit for the three months to the end of June was 425 million Swiss francs, compared with $1.02 billion for the same period last year, the Associated Press reported.

A fall in investment banking income also put a sizeable dent in the bank’s bottom line.

According to the New York Times, the investment banking division reported a pretax loss of 130 million Swiss francs in the second quarter.

“This is a weak set of results, but the big disappointment is the investment banking loss with drops in revenue in nearly all segments," Bank Sarasin analyst Rainer Skierka told Reuters.

Analysts had expected a net profit of 1.141 billion francs. Shares in UBS slumped nearly five percent in morning trade.

The story you just read is accessible and free to all because thousands of listeners and readers contribute to our nonprofit newsroom. We go deep to bring you the human-centered international reporting that you know you can trust. To do this work and to do it well, we rely on the support of our listeners. If you appreciated our coverage this year, if there was a story that made you pause or a song that moved you, would you consider making a gift to sustain our work through 2024 and beyond?