Gold prices fall amid market fears

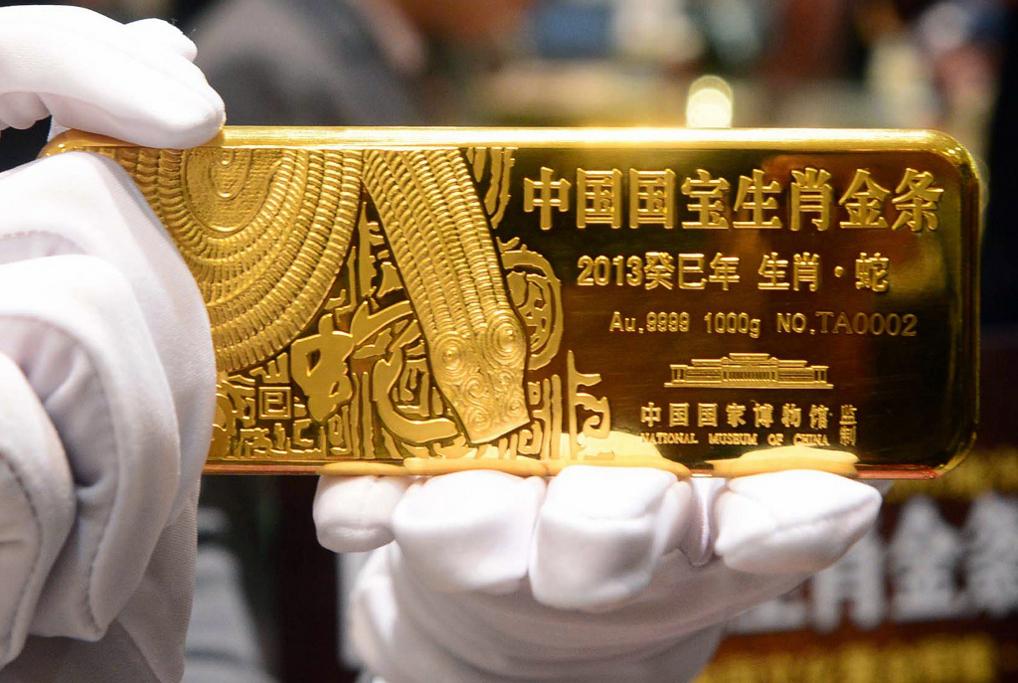

A gold bar marked for the Chinese year of the snake on November 7, 2012, Beijing, China.

Gold prices have plunged to a nearly four-month low, declining more than $30 to an intraday low of $1,662 an ounce in the midst of U.S. "fiscal cliff" talks.

The dramatic drop in gold prices began late morning as House Speaker John Boehner outlined a "Plan B" tax proposal. Gold prices declined further after White House Press Secretary Jay Carney announced President Obama's rejection of that plan. February gold futures settled at $1,670.70 an ounce.

After the close of floor trading, gold prices continued to slide to $1,662 an ounce, falling below the 200-day moving average of $1,667 an ounce. Comex floor traders say many sell stops were triggered in the decline below key technical levels, exacerbating the slide.

RBC Capital Markets precious metals analyst George Gero said sellers were also "spooked" by China's cancellation of large soybeans orders, a possible indication of a further slowdown in growth there.

Gold is now on pace for its third monthly decline, down almost 6 percent in that period.

Still, gold is one of the better performing commodities in 2012, up 7 percent this year and on track for its 12th consecutive annual gain. Some analysts remain very bullish on the metal. Bank of America Merrill Lynch analyst Francisco Blanch told CNBC earlier Tuesday he expects gold prices to reach $2,000 an ounce next year.

More from our partners at CNBC:

Every day, reporters and producers at The World are hard at work bringing you human-centered news from across the globe. But we can’t do it without you. We need your support to ensure we can continue this work for another year.

Make a gift today, and you’ll help us unlock a matching gift of $67,000!