China and Japan join the international chorus complaining about US fiscal chaos

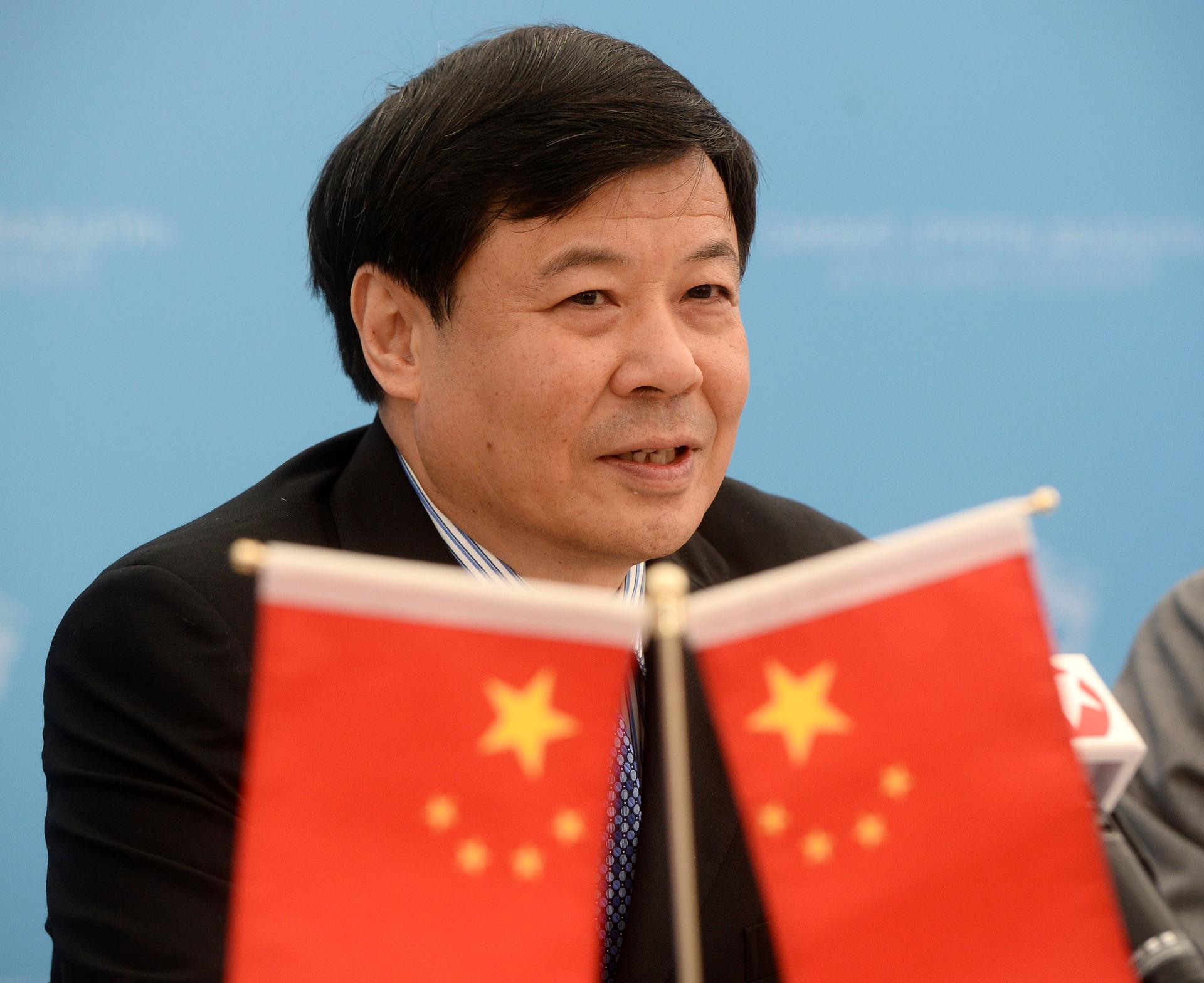

China’s Vice Finance Minister, Zhu Guangyao, at the G20 Summit in St. Petersburg, Russia, last month. Zhu is warning the US to get its fiscal house in order.

The US runs out of money on October 17th, unless Congress allows the government to borrow more money. And that's not guaranteed.

Market analysts now say there's a 40 percent chance of the US government defaulting on its debt for the first time in history. That could have disastrous impact on the global stock and bond markets, according to the International Monetary Fund.

Now China and Japan are adding their voices to the chorus of concerned critics.

China's Vice-Finance Minister Zhu Guangyao warned that failure to raise the US debt ceiling would have global ramifications.

"Because of this," Zhu said, "we naturally are paying attention to the financial deadlock in the US, and reasonably demand that the US guarantee the safety of Chinese investments there."

He also urged American leaders to take "realistic and resolute steps to ensure against default on the national debt."

But that may not be very helpful, according to Daniel Drezner, professor of political science at the Fletcher School at Tufts University. Politically, he says, several GOP representatives are prone to China-bashing, and anything that appears to hurt China might be seen as a good thing by their constituents. Even if it is a US debt default.

"Politically," says Drezner, "if they're trying to help, the best thing they can do is shut up."